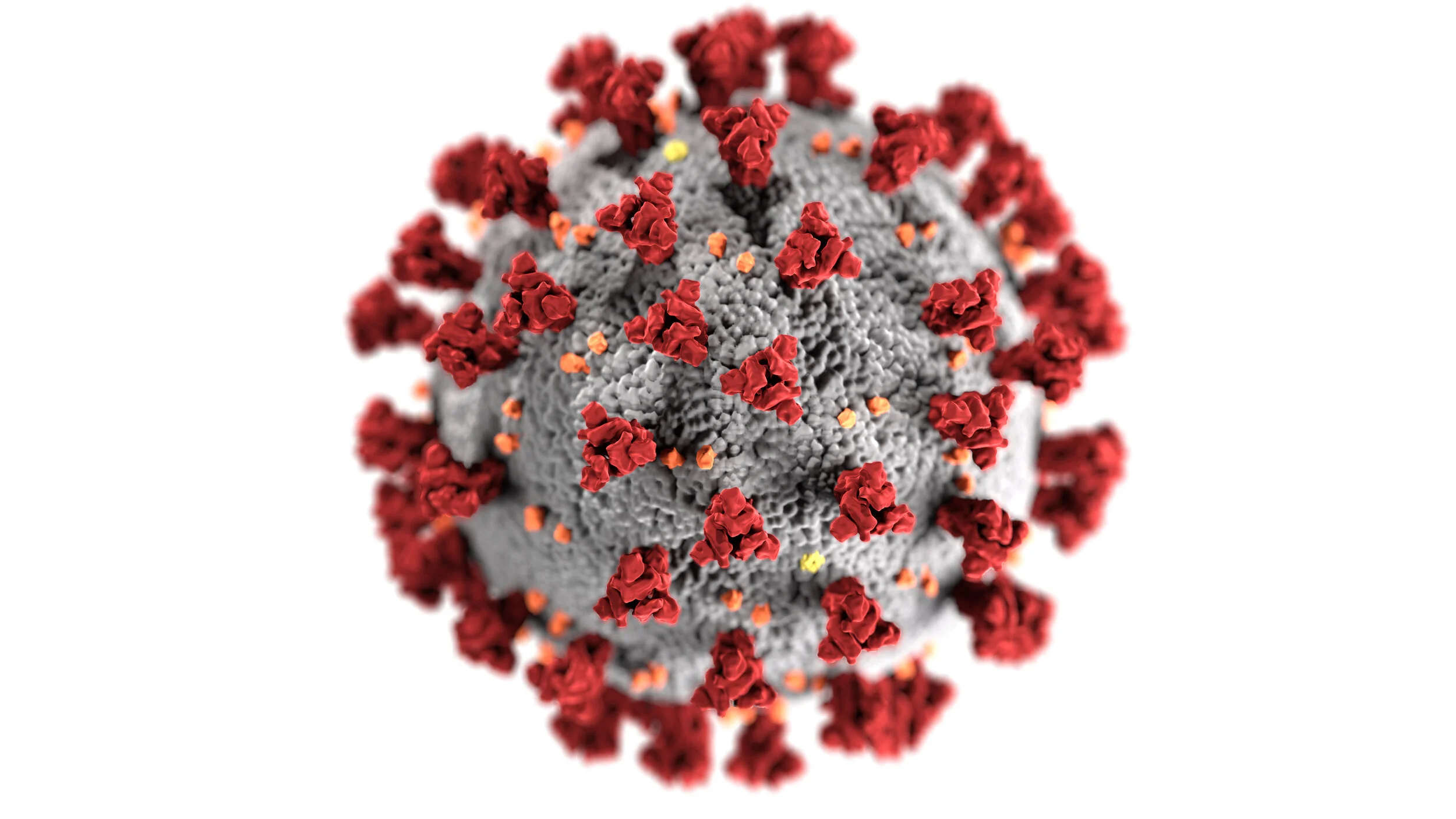

Make Better Decisions During the Coronavirus Pandemic

We’re experiencing things that we never imagined happening in our lifetime. Business Owners are dealing with situations that aren’t black and white. That’s why I’ve put together this page of resources to help give context, clarity, and wisdom to Business Owners as they seek to not only weather this storm, but come out better on the other side.

COVID Business FAQs

Answers to common questions business owners are asking

Business Articles

Short articles on topics that help you strengthen your business

PPP & EIDL Updates

Updates to new regulations & discoveries surrounding CARES

Business Resources

Simple tools to help you make informed business decisions

Zoom Consults

30 minute consults surrounding business during the pandemic

COVID Newsletter

Emails with tips & insights on doing business during COVID

COVID Business FAQs

Answers to common questions business owners are asking

My loan is more than my payroll will be for 8 weeks, so I will have money left over. Can that be forgiven?

Yes, so long as you spend it on eligible expenses which include: Rent, mortgage interest, utilities (and payroll).

Is it true that my PPP loan can be forgiven?

Yes, so long as you meet the conditions of the loan. You must spend at least 75% of the loan amount on payroll during the 8 week period (8 weeks is not the same as two months) beginning the day your money is deposited in your account.

I do not want to spend money that I have to pay back. How can I calculate the maximum I can spend?

Estimate your payroll for the 8 weeks following receipt of your loan. Divide that number by .75 and that is the maximum amount of loan you could have forgiven. (You still must spend any amount over your estimated payroll on eligible expenses.)

Is credit card interest and interest on my line of credit eligible?

Only mortgage interest on loans secured by real or personal property can be forgiven. That means no for credit card interest and maybe for line of credit card interest. LOC interest is eligible if the line of credit was secured by real or personal property before Feb 15, 2020.

What qualifies as payroll?

Total gross pay of w2 employees (not 1099 contractors) including the owner. You can add to this number health benefits and contributions to retirement plans, and sick leave pay. You must subtract the employer portion of payroll tax which is not eligible for forgiveness (although there are indication this might be changed).

My payroll is more than last year's, therefore the 8 week's forgiveness window payroll will use all of my loan. Is it okay to spend the entire amount on payroll?

My answer is not only yes, but hell yes! I have not seen an SBA statement directly addressing this issue, but putting money in employees' pockets is the whole point of the PPP program.

I got a $10,000 advance from the EIDL program and I also got a PPP loan. It is not entirely clear that both can be forgiven.

It is possible, but not certain that your EIDL advance amount will reduced the amount of your PPP loan that is forgiven. The jury is out on this one due to conflicting information. The conservative approach is to assume that the EIDL amount will offset some of your forgiven PPP loan.

What are payroll taxes?

These are the medicare, social security and FUTA taxes that you pay for employees. Your employees pay the equivalent taxes and you match them. Their share is eligible for forgiveness, your share is not.

How can I be sure my payrolls are eligible for forgiveness under PPP?

Money spent on payroll 8 weeks after receiving a PPP loan is eligible to be forgiven. So what counts for "spent on payroll 8 weeks after your loan?" After several discussions with trusted bankers, it appears eligibility depends on when payroll was paid, not earned. For example: Suppose you receive PPP funds on a Thursday and pay payroll on Friday. The amount counts for forgiveness because, even thought it was earned before, it was paid during the 8 week period. It works the other way near the end of the forgiveness period. For example: If your 8 weeks ends on a Thursday, and you pay payroll on Friday, the amount would not count for forgiveness. The prudent course it to make sure you actually pay your employees during the 8 week forgiveness period - even if it means paying an extra, short payroll early.

what qualifies for forgiveness for schedule C PPP loans?

For those with employees, understanding how to qualify for PPP loan forgiveness is easy: spend at least 75% of the loan on payroll and the balance on qualified expenses (all within 8 weeks of receiving your loan). But what if you don't have employees and got your loan based on your 2019 Schedule C?

The amount of your schedule C loan is 2.5 times your 2019 average monthly profit. There is no 75% rule for schedule C loan forgiveness, instead, 8 weeks of your 2019 average weekly profit will be forgiven automatically. Your loan was for more than that,* so you, too, must spend the balance on qualified expenses within 8 weeks.

Have a question you need answered?

PPP & EIDL Updates

Updates to new regulations & discoveries surrounding the cares Act

Ongoing Updates to the COVID-19 Crisis

We’ll continually add updates and insights to this page as we discover new developments for small businesses regarding the pandemic. Click any of the links below to view one of our previous emails sent out in our COVID Newsletter.

Zoom Consults

Every business is in a unique situation during this pandemic. Schedule a 30 minute consultation to get answers to your questions & Guidance to make better decisions.

Business Articles

Short Articles that Help You Strengthen Your Business

Small Business

& the virus

7 Facts About Profit

Growth

with No

How To Predict Business Success

Interruption Insurance

How to Create A Cash Reserve

Business Resources

Simple tools to help you make informed business decisions

More Than Just A Number

My clients are routinely startled by the insights breakeven reveals and the guidance it provides for routine decisions. Breakeven also provides valuable insight for changing our behavior and approach towards employee incentive bonuses, price increases, price decreases, marketing opportunities, and more.

Where Do You Stand?

Only 4% of the 28 million businesses in the United States ever reach a million dollars in sales. Fewer still ever reach the point where their businesses can work without them. Where do you stand among the successful few? Compare yourself to the attributes of these highly successful business owners in The Successful Business Owner Checklist.